Tips on Trading Pumps & Dumps

did you get caught up in the hype of buying a specific cryptocurrency due to all of the popularity of it, and then lost all of your money when its value crashed? Maybe you bought a stock that skyrocketed in value and then crashed, but you didn’t get out in time. Well, this is known as a pump and dump scheme. What we want to do today is talk about pumps and dumps. We are here to talk about how to identify pumps and dumps, how to trade pumps and pumps, and how to make money from them too. Right now, we are going to talk about a great pump and dump trading strategy that is going to help put money in your pocket.

What are Pumps & Dumps?

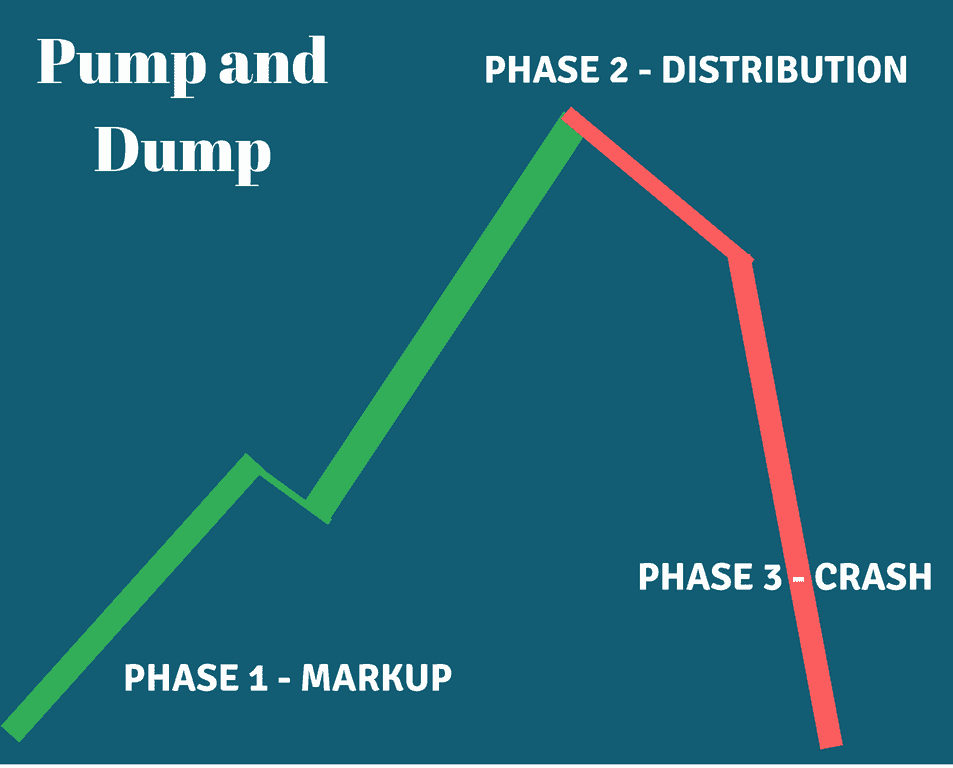

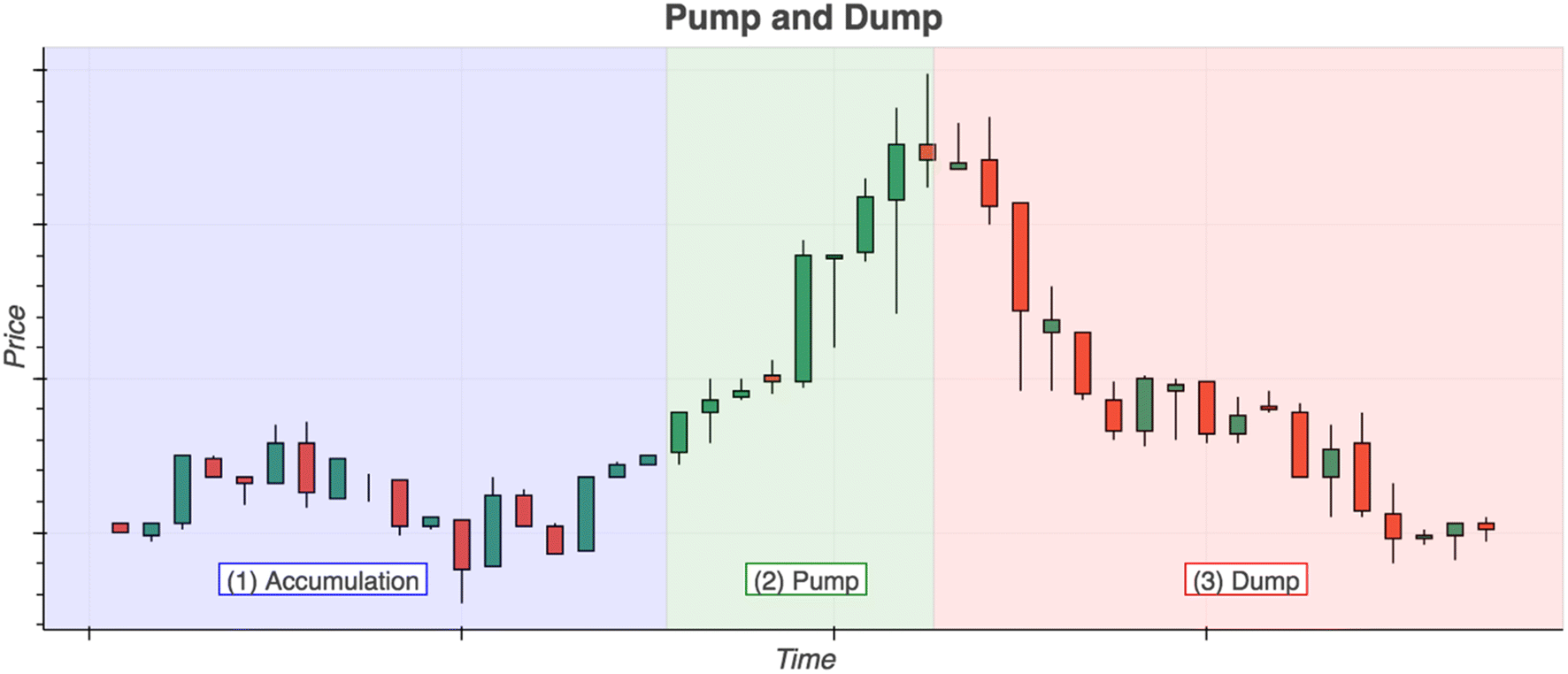

For those of you who don’t know, a pump and dump is a phenomena that happens in a market when the value of an asset or security increases exponentially and receives huge attention on a large scale. this is then dumped later on, or in other words experiences a massive sell off as the price crashes. There is a huge buy followed by a massive sell off.

Technically speaking, a lot of people will tell you that pumps and dumps are illegal, which may be true. That said, whether or not pumps and dumps are illegal is completely irrelevant, because they happen all of the time in all markets, and in all timeframes. Whether or not they are illegal and whether or not they receive media attention is totally irrelevant.

The real issue with pumps and dumps is that newbie traders usually fall for them by getting way too excited and then buying too much. Those newbie traders will then get trapped in this horrible cycle where they buy too much but then cannot sell off in time period yes, if you sell in time, you can make a whole lot of money, but if you don’t sell in time, you are going to lose everything.

Therefore, a lot of people think that they absolutely need to stay away from pumps and dumps, because they are money schemes that will make you lose everything. However, if you trade smart and you know what you are doing, you can make money from a pump and dump. In the following section, we’re going to teach you how to trade pumps and dumps, specifically how to identify when they occur and how to make money from them.

Trading Pumps & Dumps

The first thing that you need to be able to do is to of course identify a pump and dump scheme. Now, remember that they can happen on all timeframes in all markets. What you need to do here in order to identify them is to use a time frame that is not going to affect your responsibilities or get in your way. You want to be using timeframes that are going to allow for great consistency in the long run.

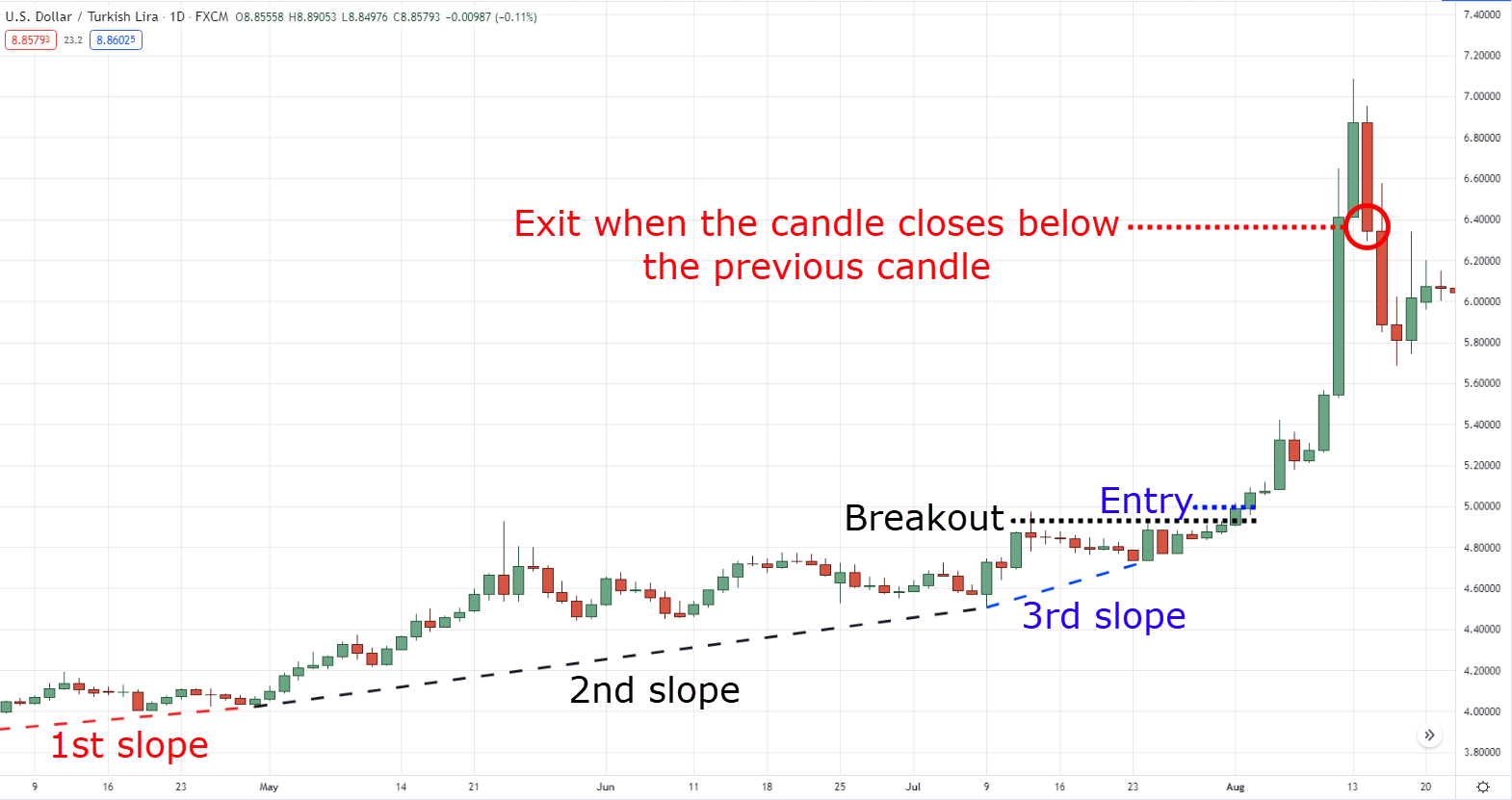

A great way to identify pumps and dumps is by using a so-called third slope strategy, and this is done by using a trendline with a charting tool. What you want to do here is to use a trend line, and then connect all of the lows using a trendline tools. You want to see three slopes, and when you see a third slope appear from the low values of the asset, then the pump has likely already started. If you see a stop strong third slope, then the pump is in process.

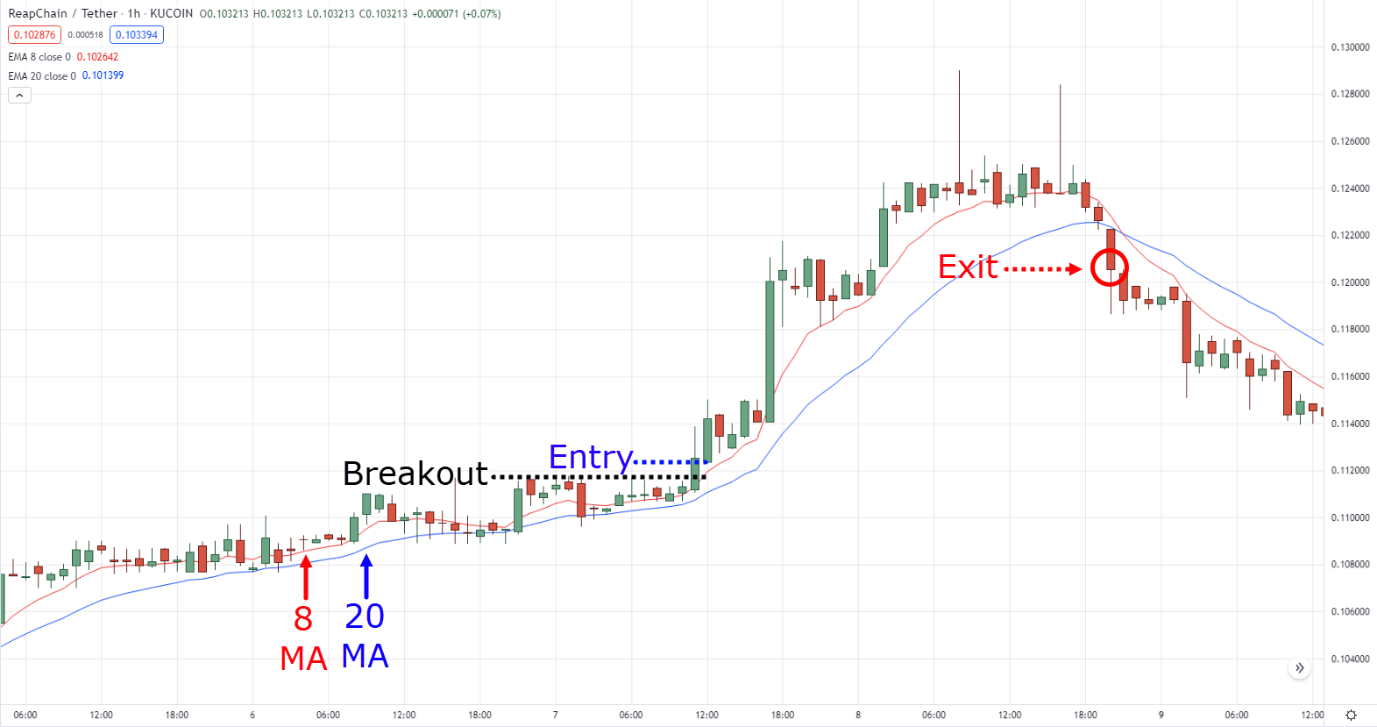

Another thing that you can do to identify pumps and dumps is to use moving averages, specifically eight daily day moving averages. You want to see the price above both of these moving averages, and you want your moving average that you are using to be very tight. This is so you can spot potential fast moving prices. Just keep in mind that when doing this, choppy markets can lead to irregular and false signals. Just keep in mind that you want to stay objective at all times.

Now, in order to make money from pumps and dumps, make sure that you don’t fall into the hype, that you use risk management, and that you do all of the necessary back testing period once you have identified a pump and dump using either the moving average or the trendline strategy, you should learn how to exit the trade in order to make money. One thing to keep in mind is that you should never buy on pullbacks because when you are dealing with volatile markets, those assets can crash at anytime.

What you want to do here is to wait for additional confirmation by waiting for a breakout to happen and for a candle to close. You can then place a trade when the next candle opens. Now, if you happen to be using a long time frame, but the structure of the market is somewhat unclear, then you can use a shorter time frame for higher reliability. What you need to know now is how to exit the trade.

Exiting a Pump and Dump

The fact of the matter is that many people are going to tell you to keep holding onto your losses in the hopes of making more money, but the fact of the matter is that you should never rely on someone else’s opinion here and you definitely don’t want to be emotionally attached to the trade. If you want to make money from pumps and dumps, you should use a trailing stop loss period you need to wait for the price to close below the 20 period Moving average, and you can also use a previous candle close trailing stop loss to exit all of your trades.

You really don’t want to be using a fixed target profit here, because you want to take advantage of the pumps and dumps as much as possible. You really don’t know how far they are going to go until they get there. For this reason, you want to stay with your trade until it reaches its maximum limit, and you then want to look for a sign of a pullback, and then get out as soon as you can period of course, trading pumps and dumps is very high risk, but if you follow the tips that we have provided you with here today, you should be able to make money from these pump and dump schemes.

Pumps and Dumps – Making Money

As you can see you, making money from pumps and dumps is not overly difficult, but it does need to be done properly. For more information on how to trade pumps and dumps, we recommend getting yourself a good trading education that will provide you with all of the tools and skills that you need to be a profitable trader.

Leave a Reply