An Introduction to Bollinger Bands

One of the most important things that you need to know all about when you first start trading are indicators. One of the most important indicators that you need to be familiar with are known as Bollinger bands. Now, for those of you don’t know, indicators are a special set of tools used in technical analysis for trading, and they can provide you with a variety of information about price data.

There are four main types of indicators out there, amazing good volatility, trend, volume, and momentum indicators. The Bollinger bands indicator is a volatility indicator, and in fact it is one of the very best out there. What we want to do today is to take a much closer look at these Bollinger bands indicators to see exactly what they can do for you.

the fact of the matter is that Bollinger bands can be a bit complicated to use, but with that being said, it is one of the all time best indicators out there in terms of volatility. What we have done today is provide you with a basic introduction to Bollinger bands. We want to show you exactly what they are, how they work, and how to trade with them. We even included one of Andrew’s best videos that describes exactly how to trade with these Bollinger bands according to a variety of time tested improvement trading strategies.

What is the Bollinger Bands Indicator?

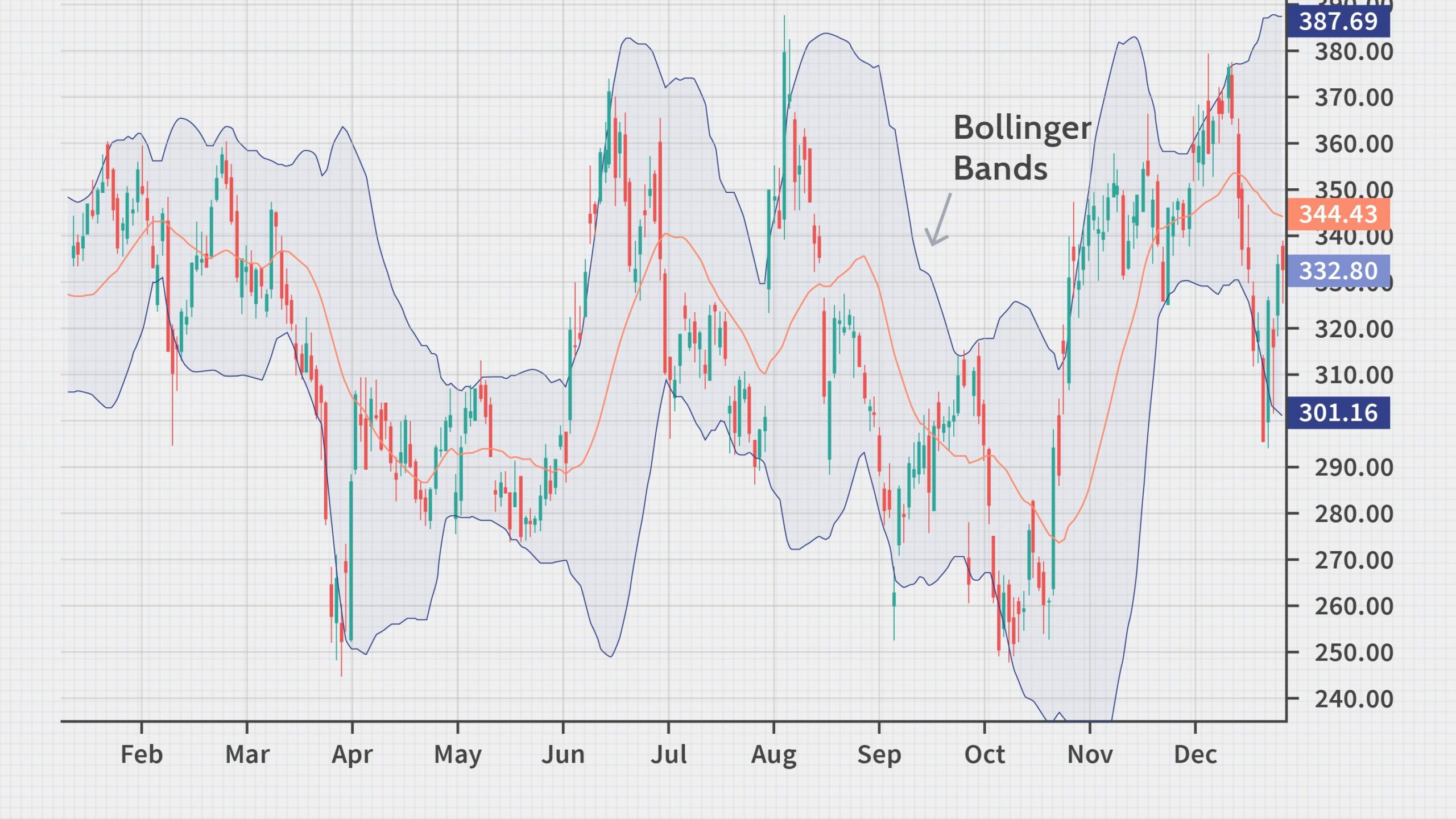

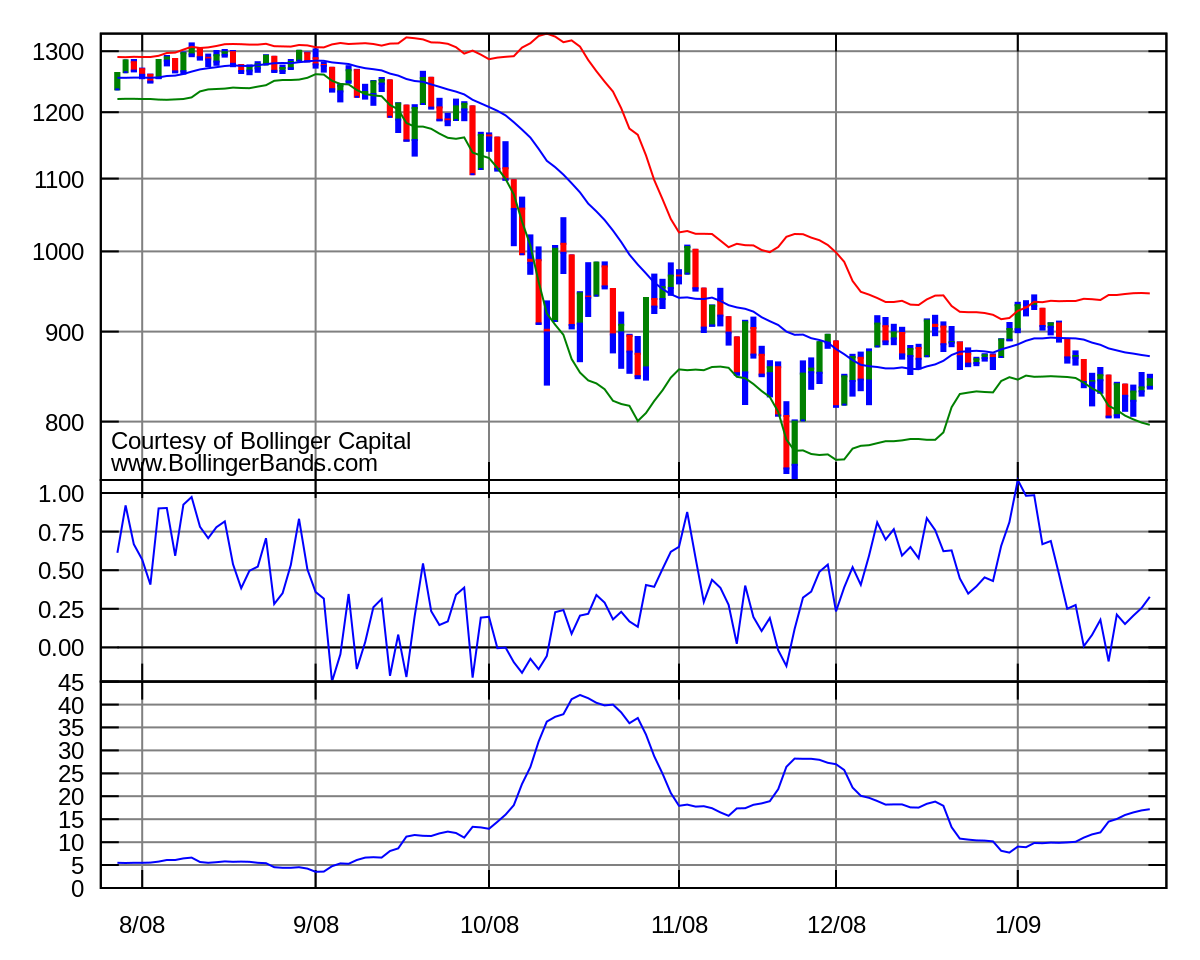

First off, Bollinger bands is a volatility indicator that was created by a man named John Bollinger in the 1980s. He developed a very special technique that used to have moving average along with two trading bands one above and one below the moving average.

Now, unlike a normal moving average that has a percentage, the Bollinger band simply adds and subtracts a standard deviation calculation. Something that you need to know here is that a standard deviation is simply a mathematical formula that measures volatility an asset or currency.

Now, by measuring the volatility of a price, the Bollinger bands indicator has the ability to adjust itself to market conditions. This is what makes the Bollinger bands indicators so useful for a variety of traders, because it provides you with virtually all of the price data that you need because it all sits in between those two bands.

The Three Components of BB

What you need to know here is that the Bollinger bands indicator consists of three main components. Being able to understand what these three main components mean is essential to your trading success.

The first and most important of these components is a simple moving average, and this is usually up an intermediate length. This is a very simple 20 day moving average, and this is often used as the default setting. This moving average can then be used for measuring the trend and also to calculate the other two elements of this indicator.

The second element of the Bollinger bands indicator is the upper band, and this is the standard deviation above the simple moving average. 2 standard deviations is usually the default used by most charting software. The third and final component of this Bollinger bands indicator is the lower band, and this is the standard deviation below the simple moving average, and it is usually two standard deviations that is the default.

What Bollinger Bands Tell You

What you do of course also need to know is exactly what this Bollinger bands indicator tells you. The bottom line here is that the closer the price moves to the upper band, the more overbought the market is, and the lower the price move to the lower band, the more oversold the market is. Perhaps the main takeaway here is that when the bands are further apart volatility is higher, and when the bands are closer together, motility is lower.

Pros and Cons of BB

The Bollinger bands indicator does have both advantages and disadvantages that you need to know about, so let’s take a quick look at exactly what these are.

Pros

- One of the biggest benefits of the BB indicator is that it is excellent for seeing volatility in a trending market.

- The Bollinger bands indicator makes for a great way to identify new and emerging trends at the end of older trends. It’s a great multi-purpose indicator in this sense.

- When it comes down to it this is one of the most popular technical indicators in the world, and it all has to do with its ease of use. It’s a great indicator for identifying volatility, momentum, and trends.

Cons

- One of the drawbacks of this indicator is that it’s not completely fail safe, and it should always be used in conjunction with a few other types of technical analysis.

- The other downside of this indicator is that it is a lagging indicator that follows recent price movements, and this might mean that traders might not get signals until price movement is already underway.

Some Important Tips for Using Bollinger Bands

Let’s quickly go over a few very important tips that you need to follow when it comes to trading with these BB.

VISIT ANDREW’S TRADING CHANNEL

- Keep in mind that when the bands tighten together it signals that there is a low level of volatility, and there’s a higher probability of a sharp price movement in either direction. This could therefore start a trending move. You do also need to observe that false moves in the opposite directions can occur, and that these may reverse right before the trend starts.

- Keep in mind that when the bands get separated by a large amount an existing trend may close due to rising volatility.

- You can always expect a strong trend continuation if the price moves out of the bands, but if the price moves right back into the bands, then the suggested strength is negated.

- If the prices bounce within the envelope of the bands, touching one and then the other, then these swings can be very useful for determining potential profit targets. For example, if the price bounces off the lower band and then passes through the moving average, then the upper band is then the profits target.

Trading with Bollinger Bands

The fact of the matter is that there are many different ways to trade using these Bollinger bands. What we want to leave you with for today is an excellent video that will describe exactly how to trade with them. Within this video, Andrew describes what the four best Bollinger bands trading strategies are. If there is one thing that you take away from today’s article, this should be it.

Trading with Bollinger Bands – Final Thoughts

The bottom line here is that if you know what BB are and how to trade with them, then your life as a trader becomes much easier. The Bollinger bands allow you to judge what the volatility in a market is like, and this helps with trend identification and reversal as well. We definitely recommend becoming intimately familiar with the Bollinger bands indicator if you plan on becoming a profitable and successful trader.

If you need help day trading, and what you need is a comprehensive education, particularly on Forex trading, then the best place to be is the Income Mentor Box Day Trading Academy. At this time, the IMB Academy is the most comprehensive, user friendly, effective, and affordable Forex trading school out there.

CLICK BELOW TO JOIN INCOME MENTOR BOX AND START MAKING REAL PROFITS!

/dotdash_INV-final-Bollinger-Band-Definition-June-2021-01-518977e3031d405497003f1747a3c250.jpg?resize=794%2C446&ssl=1)

Leave a Reply