Crucial Forex Money Management Tips

FX trading involves a great number of factors, with Forex money management being at the top of the list. If you don’t know how to manage your cash, you have come to the right place. Let’s get to it and talk about 6 crucial Forex money management tips that you absolutely need to adhere to.

Don’t Add to Losing Positions

When it comes to Forex money management tips, one of the most crucial ones for you to follow is to not add to losing positions. Now, some people may try to add money to losing positions in order to recoup losses. However, this rarely works out in the favor of the trader. If a trade is already losing, adding money to it is a very risky bet.

One thing to keep in mind here is that if you have a losing position, the chances are pretty good that you made an error in judgment and that your initial analysis was not correct. Therefore, adding money into a position that you opened up with poor judgment probably won’t go well.

Sure, there might be a chance that the trade will turn around. However, the issue here is that by this point, you aren’t fighting to make profit anymore, and instead, you are fighting just to break even. Adding more money into losing positions is a great way to flush money down the toilet.

Cut Your Losses

In terms of crucial Forex money management tips to follow, related to our first point, it’s always best to cut your losses. Simply put, while losing any amount of money is not great, it’s better to lose $200 than to lose $1,000.

For example, for a buy position, if you see that candlesticks are breaking through support levels on the higher timeframes, it’s a sign that the price is going to go south, so cut your losses early. If you have a winning position, but you see that the price may turn around at any given time, instead of risking it all for bigger profits, cut your losses early.

There is not point in holding onto a position that may cost you money, or even more money than it already has. It’s best to close losing positions, cut your losses, and then start from scratch. If you see that a trade is going south, with no end in sight, just cut your losses and move on. The fact of the matter is that you won’t win all of your trades. It’s as simple as that.

Pay Attention to Price Action at Longer Timeframes

Another crucial Forex money management tip that you need to keep in mind at all times is to always pay close attention to price action on the longer timeframes. Sure, short timeframes are great, but they just don’t give you the big picture, and this is a problem.

However, if you monitor the longer timeframes, such as 4 hour and 1 day timeframes, you can get some advanced warning on changing prices and trends. It’s also always a good idea to set up alerts for open positions, so if the price reaches a certain point, you will be notified. The best Forex traders out there always analyze a number of different timeframes in order to achieve the best results.

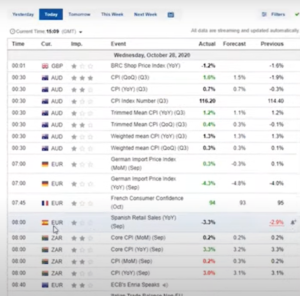

Pay Attention to Fundamental News

Yet another crucial Forex money management tip for you to follow is to always pay attention to fundamental news. Sure, some traders might not use fundamental news, but those are either pros or just plain crazy. For anybody who wants to make serious money in Forex, keeping an eye on fundamental news developments is essential.

In particular, one big thing to look out for here is 3 Bull News. People, always close your trades before 3 Bull News hits, especially for any currencies that are displaying said 3 Bull News. To check for 3 Bull News, go to the economic calendar on investing.com.

Any currencies that are showing 3 Bull News should not be traded with for that given time. Once that 3 Bull News has passed, say by about 30 minutes, then, based on the market situation, you may be able to begin trading with that currency once again.

Let Winning Trades Win

Ok, so this is a Forex money management tip that we really should not have to give you, but for some reason, most people don’t seem to be aware of it. Folks, many people, when their positions are in the green, or in other words, profitable, will often close their trades in order to bank some profits. Sure, this is fine, especially if you are engaging in high risk management.

However, that said, if there is no sign that the position will turn around, and if it looks like said position will continue to increase in value for you, then there is absolutely no point in closing the trade. If a trade appears to be profiting, and if it appears that it will continue to do so, then enjoy the ride and let the profits build. Just keep a close eye out for signs that the price will turn around, in which case, closing the trade is recommended.

Don’t Trade with What You Can’t Afford to Lose

This is another one of those obvious Forex money management tips that people don’t seem to follow, even though it does seem self-explanatory. People, never trade with money you cannot afford to lose.

This means that if you need to choose between Forex trading and eating dinner or paying your rent, take a wild guess as to which one takes precedent. Forex trading can be and is profitable if done right, but you can just as easily lose money. Therefore, if you lose money, it better not be money that you needed for something essential.

Forex Money Management 101 – Conclusion

The 6 Forex money management tips that we have provide you with here today are by far the most crucial ones for you to follow. If you do, your chances of making money are greatly increased.

CLICK BELOW TO JOIN INCOME MENTOR BOX AND START MAKING REAL PROFITS!

If you would like to find out more about cryptocurrencies and cryptocurrency trading, go to our Cryptocurrency Explained section!

Leave a Reply